THIS POST INCLUDES:

——————————————–

1. Reiki Practice Financial Information

2. Using Excel or Accounting Software

3. Cloud Based or Installed Software

5. How to decide what software to use

6. Free Download Expenses Worksheet

REIKI PRACTICE FINANCIAL INFORMATION

As a therapist running your own private practice, you are required to record financial information to determine your tax obligations each year.

In addition to calculating your tax obligations, you can also gain ins=sight into the profitability of your practice through your financial information. You can analyze your business income and expenses and make decisions about your business that will help your private practice become more profitable.

Some of the most common types of financial information you need to record are:

- Income

- Expenses

- Assets – furniture, equipment, property etc

- Liabilities – loans, leases

- Salary

- Retirement – Superannuation, 401K etc

- Taxes

The information that you are required to record is based on the country where you are operating your private practice.

USING EXCEL OR ACCOUNTING SOFTWARE

The most common software that is used to record financial information is Microsoft Excel or purpose built accounting software. Below is a list of advantages and disadvantages of both Excel and accounting software. It’s important to remember that you can change your system at any time so you may choose to use Excel in the initial stages of building your private practice and then upgrade to using more sophisticated accounting software.

ADVANTAGES AND DISADVANTAGES OF EXCEL

Below are some of the advantages and disadvantages of Excel:

ADVANTAGES:

- Excel requires fewer upgrades

- Excel is easy to edit data due to less compliance and auditing features (see disadvantage also)

- Easy to send an Excel file to your accountant

- Lower ongoing costs

- Excel can be a more simplified way to record data

- Excel is a commonly known program that most people are familiar with

- You can create spreadsheets and reports that are specific to your private practice needs

- Download free templates available to suit your business

- Quick learning curve as most people are familiar with Excel

- Easy to integrate with other software

DISADVANTAGES:

- Working with excel formulas may be challenging for some people

- Using Excel formulas can increase the chance of errors

- Data is easily changeable with no accounting compliance or auditing features

- Managing multiple spreadsheets or files can be onerous

- Errors may occur due to multiple versions when sharing an excel file

- May need to create financial documentation that 3rd parties may require eg. Invoices

- It can be time consuming to update spreadsheets for any significant changes to your business operations

- More time consuming to produce tax reporting requirements

- More time consuming to create reports

ADVANTAGES AND DISADVANTAGES OF ACCOUNTING SOFTWARE

Below are some of the advantages and disadvantages of using either installed or cloud based accounting software.

ADVANTAGES:

- Central file is maintained which reduces the risk of version control problems

- Accounting compliance and auditing requirements

- Integration with online banking to record financial information automatically

- Easy to produce tax reports

- Easy to use built in reporting

- Includes payroll systems

DISADVANTAGES:

- Increased learning curve due to the uniqueness of software

- Software should be updated regularly which can involve additional costs

- Data entry and reports can be too general and not specific to your private practice

- A difficulty with integrating data with other software

CLOUD BASED OR INSTALLED SOFTWARE

The use of cloud based software is becoming more popular. One of the benefits of using cloud based software is the ability to access the program and your data from anywhere using mostly any device, as long as you have an internet connection.

This portability of your data means you can provide access to your financial information to a 3rd party such as a bookkeeper or accountant. Cloud based software also offers multiple user accounts (usually for an additional fee) if you wish someone else with access on an ongoing basis.

Cloud based software generally involves less manual upgrades as the software you are log into is the most updated version. Cloud based software also means your data is regularly backed up on a 3rd party server which means you can still access your data if your computer or device becomes damaged or lost. The downside of these features is that you have to pay an ongoing monthly or annual fee to access your data. Cloud based systems are also susceptible to hacking of your data and your password details.

Using cloud based software means you need an internet connection to access your data. This is not a significant problem given our access to the internet, however it can have an impact if the cloud based provider is offline or has an outage. This can create some business disruption which is important if you are generating invoices for payment from cloud based software.

Using cloud based software is a commitment to using the services from that company. If you decide in the future that you no longer wish to use their service, you will need to export your data to use in another service.

Using installed software is not as portable as cloud based software. Additionally, installed software is updated on a less regular basis compared to cloud based software, however, the potential to being hacked is reduced as you work in your software offline.

Using installed software provides you with more control over the total cost and ability to access to your data, however, cloud based software can provide you with various ways of accessing your data with your data being regularly backed up. If you use installed software, you will need to ensure that you back up your own data regularly.

HOW TO DECIDE WHAT SOFTWARE TO USE

The program that you decide to use will depend on the stage of your private practice. Initially, you may be focused on controlling costs. You may already have access to Excel and can easily keep a list of income and expenses in a spreadsheet.

As your practice grows and becomes more complex with additional services, products, and possibly other staff, you may want to transition to an accounting software package that incorporates invoicing, payroll and comprehensive reporting.

Your choice of what software to use and when will be based on your budget, your technical skill level, and the complexity of your financial requirements.

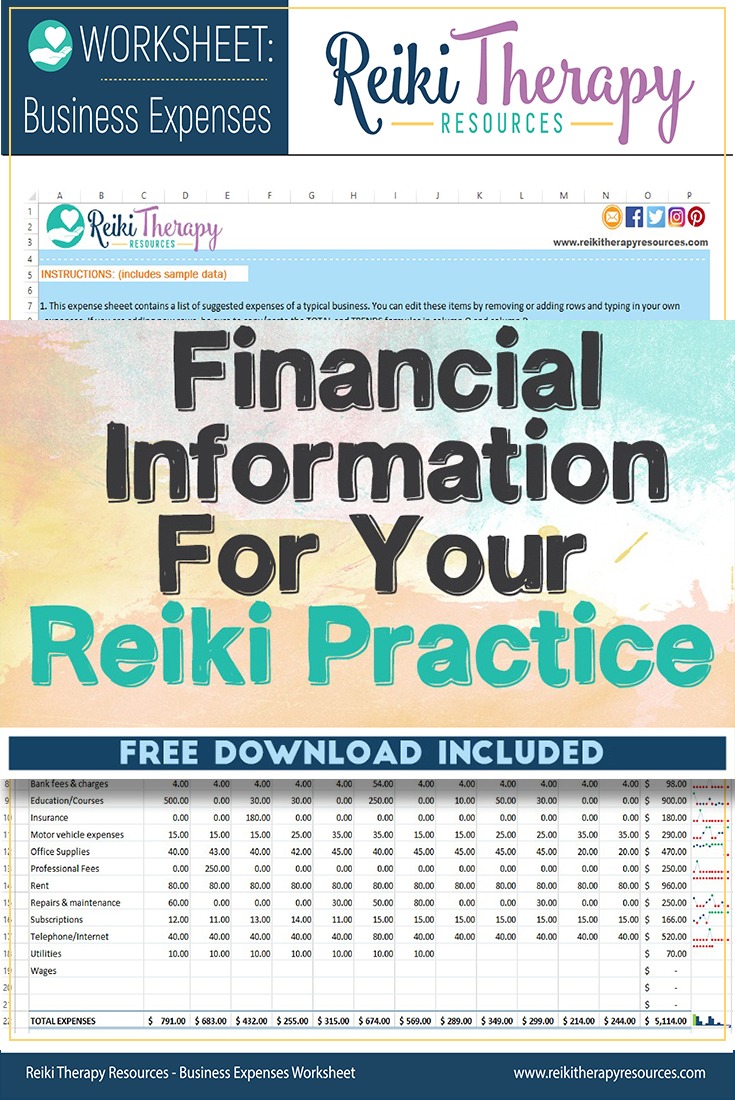

FREE DOWNLOAD

SIGN UP below to receive your FREE DOWNLOAD. Once you enter your email address, you will receive access to the Free Expenses Worksheet to record your Reiki Practice financial information.

BUILD YOUR REIKI REFERENCE MATERIALS:

Pin this image to your Pinterest board.

SHARE KNOWLEDGE & PASS IT ON:

If you’ve enjoyed this post, please share it on Facebook, Twitter, Pinterest. Thank you!